The United States has long held a privileged position on the world stage. Our economy” target=”_blank”>economy< continues to take actions that directly threaten this position as a world leader.

By spending more than we have and acquiring a executive that now sits at a jaw-dropping $28.2 trillion, we undermine our economy and will eventually lower the value of our own currency.

LIZ PEEK: BIDEN’S FAKE ECONOMIC NEWS – THIS IS HOW DEMOCRATS JUSTIFY THEIR RADICAN SPENDING BINGE

Our staggering national debt has direct and severe consequences for our economy, household incomes and savings, policy decisions, national security and ultimately, American exceptionalism.

Yet, Congress, with the support of both Democrats and Republicans, passes bill after bill with price tags in the trillions and we don’t make plans to pay for them.

CLICK HERE TO GET THE OPINION NEWSLETTER

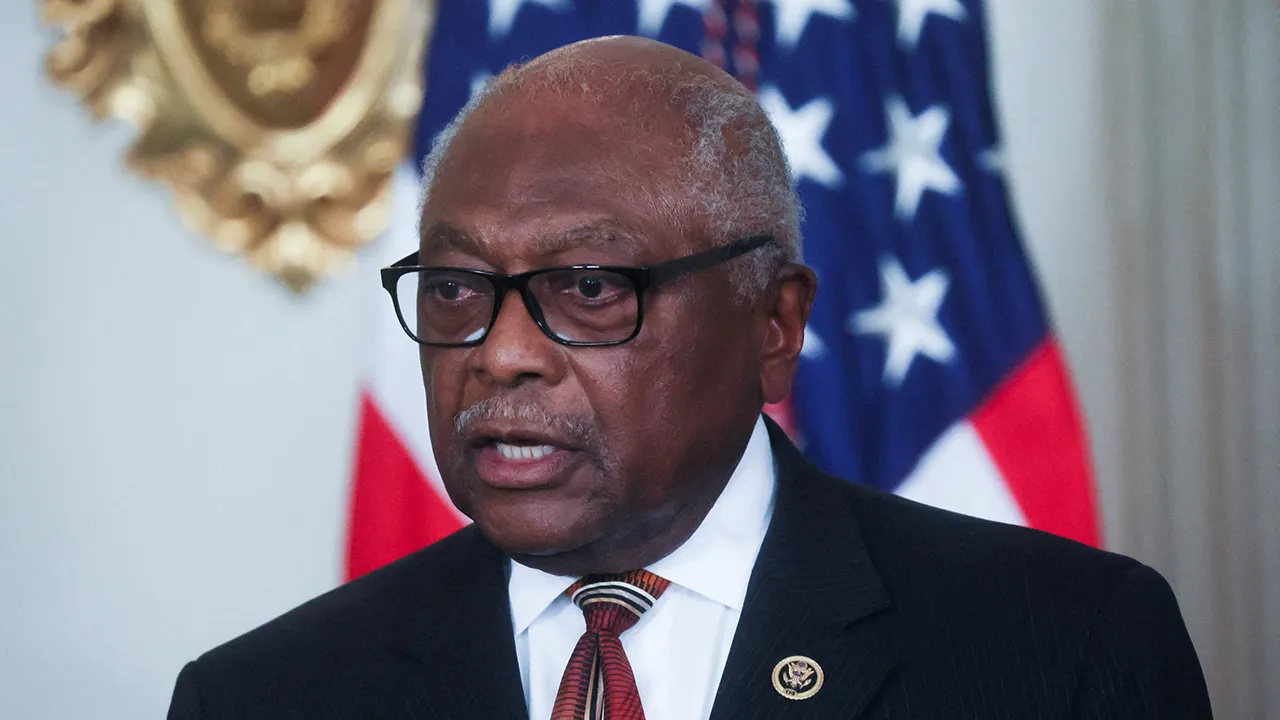

When I was in the House of Representatives, I balked at our $14 trillion in debt. I voted against President Obama’s budgets mainly because of the high level of spending. Those proposals look prudent compared to what we’re churning out now.

At the rate we are going, the Congressional Budget Office has warned that the United States could soon spend more money on interest on the national debt than it does on defense.

More from Opinion

- David Bossie: Biden the green radical – ‘infrastructure’ spending binge tells you this about who’s in charge

- Albert Eisenberg: ‘Cancel’ student debt? Sorry, Sen. Warren, but I don’t want to burden others with my choices

- Rep. Nancy Mace: Biden’s ‘infrastructure’ fiasco – Dems offering Green New Deal in sheep’s clothing

You know things are bad when former Obama officials start raising the alarm about our national debt and the inflation risks it poses.

In an editorial in the New York Times, Steven Rattner, a counselor to the Treasury secretary in the Obama administration, said, “Wasting precious dollars that could be better spent can’t possibly be worth the risk of igniting high inflation again.” His concern was in reference to the last COVID relief package passed by Congress. Mr. Rattner, I agree with you completely.

Serious work is needed to pull ourselves out of this pit. We can’t stick to the status quo and expect a different outcome. We need real bipartisan solutions to our debt problem.

That’s why I’m introducing the Sustainable Budget Act. This bill will create a commission that will work on bipartisan, realistic solutions to our budget crisis. In 2010, the Simpson-Bowles Commission (co-chaired by former Wyoming Sen. Al Simpson) worked on a plan to cut the debt by $4 trillion. At this point, we need something far more ambitious than the Simpson-Bowles plan to make a difference.

The national debt is no longer an abstract worry without real world consequences.

The commission I’m proposing would be comprised of individuals of both parties nominated by the president, the speaker of the House, the House minority leader, and the Senate majority and minority leaders. They’d be tasked with creating a plan to reduce the deficit and balance the federal budget within 10 years. The solution must be bipartisan, and must have the approval of two-thirds of the committee.

If the commission succeeds, it’s dismantled. If they fail, they’re dismantled and we’ll try something else. We’re not creating another government commission that gets paid a lot of money to do a lot of nothing.

However, we’re also not creating a group to pat Congress on the back for grandstanding and platitudes. It’s our job as elected representatives to find solutions and make significant changes to the way we spend taxpayer dollars.

The national debt is no longer an abstract worry without real world consequences. It will surpass $30 trillion in very short order.

The more we have to pay on our debt, the less money is available for infrastructure and addressing poverty in our nation. We can’t address any of our priorities if we have to continue talking about our reckless spending habits. It’s time to take decisive, bipartisan action and change our trajectory.

Our place at the center of the global economy is not a right, it’s a privilege. We need to take serious action now to defend that place for generations to come.