OutKick

Cowboys QB Joe Milton Relieved After Leaving New England Patriots

Dodgers' Mookie Betts Announces Death Of Family Member After Recent Absence

NBA Free Agent Marcus Morris Sr. Arrested In Florida On Felony Fraud Charge

San Francisco 49ers DE Tarron Jackson Collapses At Practice

Digital Originals

Economy

Fox News Flash

Personal Finance

Obama Foundation adds outgoing Ford Foundation president to board of directors

How the 'big, beautiful bill' gives American babies a financial head start for their future

USPS stamp prices rise: What to know

Bill Gates drops $51B in one week following vow not to die rich

Technology

Movies

Business

Haunting Japanese ghost town frozen in time sheds light on country's turbulent economic past

Lutnick backs Trump’s ‘50-50’ odds of striking trade deal with EU ahead of August deadline

China, India fuel Russia war machine by ignoring international sanctions: report

President Trump in Scotland: Everything you need to know about Europe’s oil capital, Aberdeen

Food + Drink

FOX Weather

Tropical Atlantic to heat up in August with 2 areas of concern for development

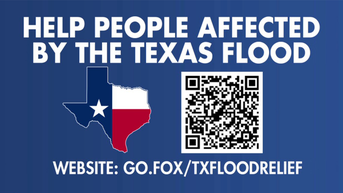

Flooding northwest of St. Louis leads to swift-water rescues, evacuations

Dangerous heat dome begins baking more than 125 million across Southeast

Tropical Depression 1-C forms southeast of Hawaii in Central Pacific

Full Episodes

Latest Wires

Media

Antisemitism Exposed

Immigration

Fox News Podcasts

Detroit Tigers Sweep Toronto Blue Jays

Extra: How A ‘Fentanyl Father’ Turned His Grief Into Activism

Nick Hogan Pays Tribute to His Father, the Hulkster on Instagram

Billy Joel Clears DUI Rumors