Designated low-income areas known as “opportunity zones” that attract investments by offering tax-related benefits have resulted in positive impacts in many states across the U.S., generating tens of billions of dollars for the affected neighborhoods, according to a new report from the Government Accountability Office.

According to the GAO report, preliminary IRS data from 2019 showed that in that year, 17,891 investors contributed $28,910,000,000 in investments in more than 6,000 “Qualified Opportunity Funds,” which are investment vehicles dedicated to the more than 8,700 opportunity zones.

WHAT ARE OPPORTUNITY ZONES AND WHERE ARE THEY LOCATED IN THE US?

“Opportunity Zones are changing the game for thousands of communities across our country. Empowering the private sector to make direct investments in underserved communities is breathing life in neighborhoods that wouldn’t have happened otherwise,” said Sen. Tim Scott, R-S.C., a strong proponent of the initiative. “This new report further proves that the 2017 tax cut delivered relief for the most vulnerable Americans and stands in stark contrast to the devastating impact of Democrats’ reckless spending and taxing plans.”

Sen. Tim Scott, R-S.C., questions Chris Magnus as he appears before a Senate Finance Committee hearing on his nomination to be the next U.S. Customs and Border Protection commissioner in the Dirksen Senate Office Building on Capitol Hill in Washington, D.C., Oct. 19, 2021.

(Rod Lamkey/Pool via REUTERS)

The GAO report included the findings that out of 50 states, Washington, D.C., and six U.S. territories, 20 said they saw positive results and only one cited a negative impact from the program, which was established with Trump-era tax cuts in 2017. Ten said they saw a net neutral result, five saw no impact at all, and another 20 said they were unsure, as sufficient data was unavailable.

“Based on case studies of Qualified Opportunity Funds,” the report said, “the tax incentive attracted investment in a variety of projects, including multifamily housing, self-storage facilities, and renewable energy businesses.”

BEN CARSON AND BROOKE ROLLINS: OPPORTUNITY ZONES KEY TO LIFTING PEOPLE OUT OF POVERTY

The report was requested from both Democratic and Republican lawmakers, including Scott and Sens. Cory Booker, D-N.J., Chuck Grassley, R-Iowa, Ron Wyden, D-Ore., and Richard Neal, D-Mass.

One concern about opportunity zones was that it would lead to greater gentrification, but GAO only heard from one state that claimed that this was a problem for them.

In practice, the report said, qualified funds found that the tax incentive program appeared to lead companies “to invest in projects and locations that they otherwise would not have.”

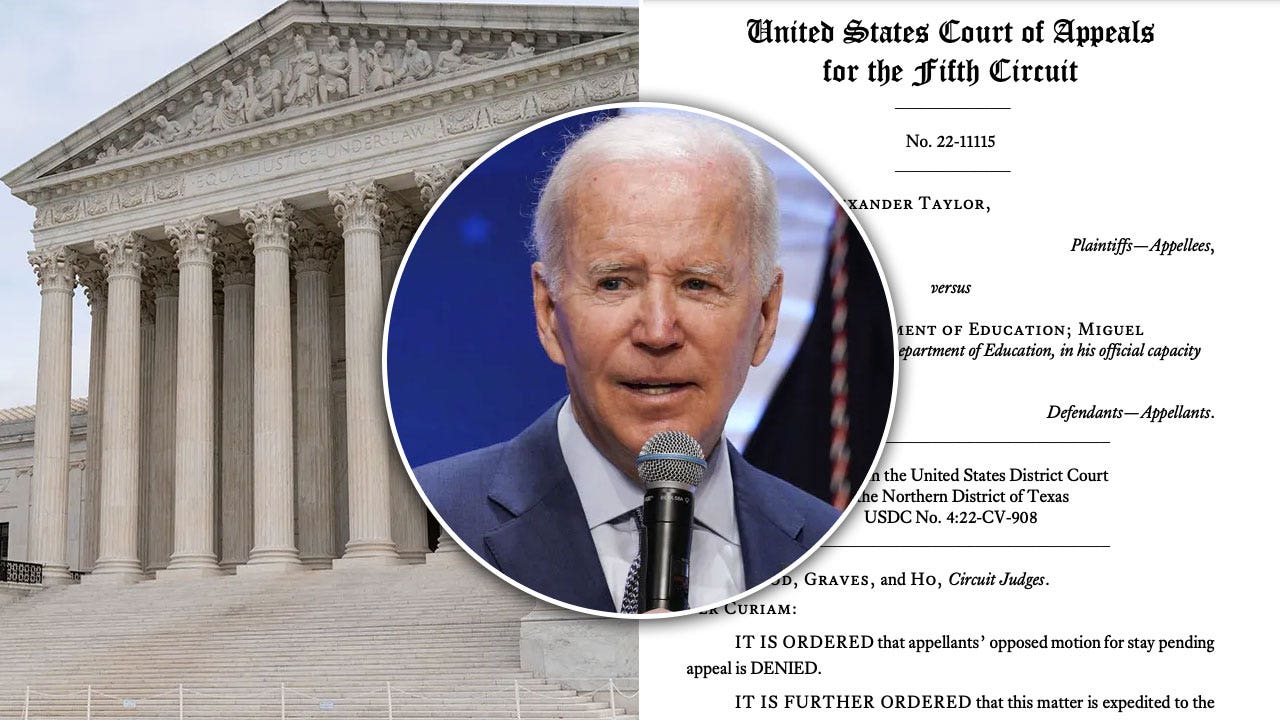

Homes stand in a neighborhood in this aerial photograph taken over Chicago, on Wednesday, Jan. 8, 2020. The area is part of an opportunity zone.

(Daniel Acker/Bloomberg via Getty Images)

“For example,” the report said, “a fund that built an industrial warehouse facility would not have pursued this project if the incentive did not exist. Representatives from four funds said they would have considered, and likely invested in, different locations if not for the incentive.”

In four other cases, however, the GAO heard from representatives who said their funds’ investments would have been made regardless of the incentives, although one fund said that without the program they would have held their property for a shorter length of time, and another said that the incentives “sped up their decision-making.”

CLICK HERE TO GET THE FOX NEWS APP

The longer an investment is held in an opportunity fund, the greater the tax benefits.

The report did note that the coronavirus pandemic hurt some of the funds, as it delayed development activities. In some cases it hindered fundraising and in others, it made it difficult for properties to achieve full occupancy.